Understanding the Role and Rights of a Guarantor

When securing a loan, especially when the borrower does not have sufficient credit history or collateral, having a guarantor can be crucial. At Oasis Capital, we recognize the importance of guarantors in the lending process. This article aims to shed light on the critical role and rights of a guarantor, ensuring that both guarantors and borrowers understand their responsibilities and legal standings.

What is a Guarantor?

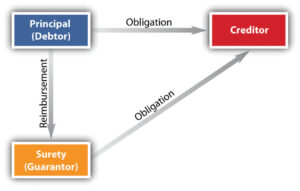

A guarantor is a person who agrees to repay a borrower’s debt in case the borrower defaults on a loan obligation. Guarantors are often used in personal loans, auto loans, and mortgages, providing additional security to lenders and facilitating access to credit for borrowers.

Role of a Guarantor

1. Credit Security: A guarantor provides a promise to the lender that they will fulfill the debt obligations if the primary borrower fails to make payments. This security allows lenders like Oasis Capital to extend credit to individuals who might otherwise be ineligible.

2. Enhancing Borrower Eligibility: By agreeing to be a guarantor, you help a borrower access financial products and amounts that might not be available to them based on their creditworthiness alone. This can be particularly beneficial for young individuals or small businesses just beginning to establish their credit histories.

Rights of a Guarantor

1. Right to Information: Guarantors have the right to receive all relevant information about the loan agreement before agreeing to the commitment. This includes the loan amount, the terms of repayment, the interest rates, and any other obligations that might affect them.

2. Right to Limit Liability: Guarantors can negotiate their extent of liability. For instance, they might guarantee only a portion of the loan or limit the guarantee to a certain period within the loan term.

3. Right to Be Notified: Guarantors have the right to be informed about any significant developments concerning the loan, including late payments or changes in the loan terms. This helps guarantors assess their risk and take appropriate actions if necessary.

4. Right to Recourse: If a guarantor has to pay off the borrower’s debt, they have the right to pursue the borrower for reimbursement of the amount they have paid on the borrower’s behalf.

Responsibilities of a Guarantor

1. Understand the Commitment: Being a guarantor is a significant financial responsibility. Guarantors should fully understand the terms of the loan and their liabilities before agreeing to the arrangement.

2. Monitor the Loan: It is wise for guarantors to keep in contact with the borrower to monitor the loan’s repayment status. This proactive approach can help prevent situations where the guarantor needs to make payments.

3. Seek Independent Advice: Before agreeing to become a guarantor, it’s advisable to consult with a financial advisor or a lawyer. This ensures that the guarantor fully understands their rights and obligations.

Conclusion

The role of a guarantor is pivotal in facilitating broader access to credit and helping borrowers achieve their financial goals. However, it comes with significant responsibilities. At Oasis Capital, we ensure that all parties involved in a guarantor arrangement are fully informed and comfortable with the terms of the agreement. Understanding the rights and responsibilities of being a guarantor can help prevent financial misunderstandings and foster healthier financial transactions.

For more information or personalized advice, visit the Oasis Capital website or contact one of our experts. We’re here to help you navigate your financial journey safely and effectively.