Strategies to Secure the Lowest Mortgage Rate with Oasis Capital

Navigating the complexities of acquiring a mortgage with favorable terms can significantly impact your financial health. Oasis Capital is dedicated to helping you understand and utilize strategies to secure the lowest possible mortgage rate. Here’s an extended guide on how to effectively lower your mortgage rate through prudent planning and informed decisions.

1. Enhance Your Credit Score

Building a Strong Credit History: A robust credit score is essential as it influences the interest rates offered by lenders. To improve your credit score, focus on making timely payments and reducing your credit utilization. This will not only enhance your payment history but also positively affect your overall credit standing, making it easier for you to secure more competitive mortgage options from various lenders.

Continuous Monitoring: Regularly review your credit report to correct any discrepancies. This proactive approach ensures your credit profile accurately reflects your financial behavior, enhancing your credibility to lenders.

2. Opt for Shorter Mortgage Terms

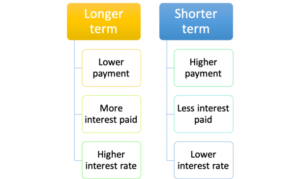

Benefits of Shorter Durations: Choosing a shorter mortgage term generally comes with lower interest rates. Although this may require higher monthly payments, the long-term savings on interest can be substantial, reducing the overall cost of your loan significantly.

Financial Planning: Ensure that your budget can accommodate the higher monthly payments that come with shorter mortgage terms. This may involve adjusting your monthly budget to prioritize your mortgage commitments.

3. Consider Re-mortgaging

Strategic Re-mortgaging: If you’re grappling with unfavorable terms on your current mortgage, consider re-mortgaging to another lender. This involves transferring your mortgage while staying in the same property, potentially to take advantage of better rates and terms as your property value increases or market conditions improve.

Timing and Costs: The optimal time for re-mortgaging is typically when your current deal is about to expire. Be mindful of the costs associated with switching, including legal fees, valuation fees, and any administrative expenses. Some lenders offer incentives like fee-free transfers, which can further enhance savings.

4. Thorough Research and Comparison

In-depth Market Research: Before committing to a mortgage, research extensively to understand all associated costs and the interest rates offered by different lenders. This includes identifying any hidden fees that could impact the total cost of your mortgage.

Negotiation Leverage: Having multiple offers in hand provides significant negotiating power. You can use a favorable interest rate from one lender as leverage to negotiate lower closing costs with another, optimizing your overall mortgage terms.

5. Explore Different Mortgage Rate Types

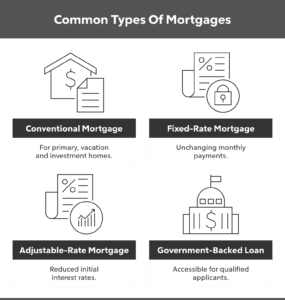

Fixed-Rate Mortgage: This type offers a constant interest rate throughout the loan duration, providing predictable monthly payments and financial stability.

Adjustable-Rate Mortgage (ARM): Initially lower interest rates make ARMs attractive, especially if you plan on selling or refinancing before rates rise. However, be prepared for potential rate increases in the future.

Hybrid ARMs: These start with a fixed rate for a predetermined period before switching to an adjustable rate. This can be a strategic choice if you anticipate changes in your financial situation or market conditions.

Conclusion

Achieving a low mortgage rate is crucial for maintaining manageable payments and overall financial wellness. At Oasis Capital, we are committed to providing you with the knowledge and resources to navigate the mortgage process effectively. By enhancing your creditworthiness, choosing the right mortgage term, considering re-mortgaging, conducting thorough research, and understanding different rate types, you can secure the best possible conditions for your home loan. Let Oasis Capital guide you through each step, ensuring you make the best financial decisions for your future.